The rise of 3D printing has significantly transformed the manufacturing and technology sectors, creating new possibilities for growth and innovation. As the technology advances, it presents a wealth of opportunities for investors seeking to capitalize on emerging trends. This blog post takes an in-depth look at 3D printing stocks, offering valuable insights from 5starsstocks.com, a platform known for uncovering high-potential investment opportunities in this groundbreaking field.

We will explore the key players, trends, and future prospects within the 3D printing market, providing a comprehensive overview for those looking to make informed investment decisions in this revolutionary industry.

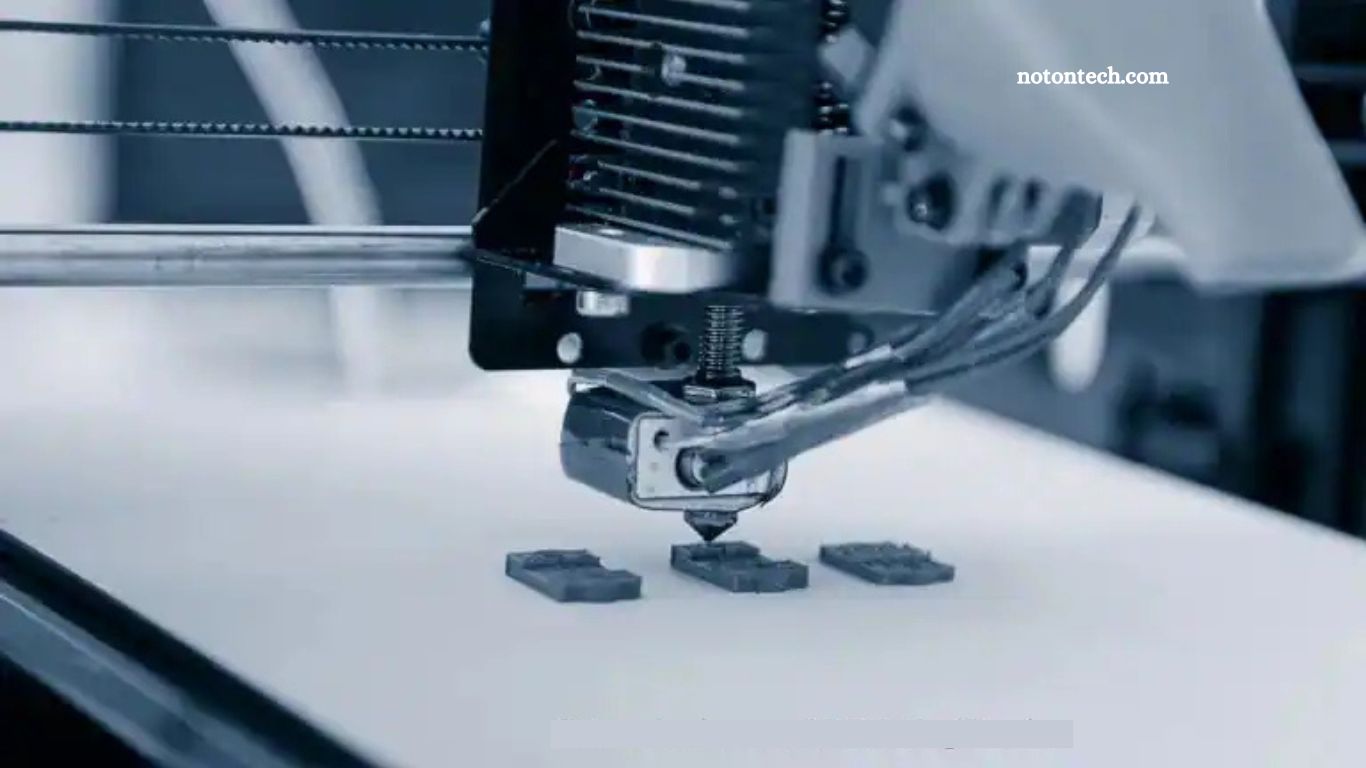

Understanding 3D Printing Technology

Before exploring the stock market potential, it’s important to grasp the basics of 3D printing. Also known as additive manufacturing, this innovative process creates three-dimensional objects from a digital file by layering material in precise increments. The versatility of 3D printing makes it suitable for industries like aerospace, healthcare, automotive, and consumer goods, offering a wide range of applications that continue to expand.

Read More: An In-Depth Guide to icryptox.com DeFi

Current Trends in 3D Printing

The 3D printing market has experienced remarkable growth in recent years. Industry projections estimate the global market will exceed $41 billion by 2026, driven by a compound annual growth rate (CAGR) of around 14.4%. Key factors fueling this growth include:

Rapid Prototyping: 3D printing accelerates prototype development, enabling faster product iteration and market readiness.

Customization: 3D printing enables the production of highly tailored products, meeting specific consumer or business needs.

Cost Efficiency: The technology reduces material waste and lowers labor costs, resulting in more affordable manufacturing.

The Investment Potential of 3D Printing Stocks

Investing in 3D printing stocks presents significant opportunities due to the disruptive nature of this technology. 5starsstocks.com serves as a valuable resource for identifying top companies leading this revolutionary field. Below, we highlight some key 3D printing stocks worth considering for your portfolio.

Leading 3D Printing Companies to Watch

Stratasys Ltd. (NASDAQ: SSYS)

Stratasys stands as a major player in the 3D printing industry, offering a wide array of printers, materials, and cloud-based solutions. With a solid presence in both industrial and consumer markets, Stratasys remains a strong investment option.

3D Systems Corporation (NYSE: DDD)

A pioneer in the 3D printing space, 3D Systems has expanded its portfolio to include materials, software, and healthcare solutions. Their focus on continuous innovation makes them an appealing choice for investors seeking long-term growth.

Desktop Metal, Inc. (NYSE: DM)

A newer entrant to the market, Desktop Metal specializes in advanced 3D printing technologies for producing high-performance metal parts. As demand for metal 3D printing increases, this stock offers substantial growth potential.

Markforged, Inc. (NYSE: MKFG)

Markforged has gained recognition for its unique ability to print composite materials and metals. With companies increasingly adopting 3D printing in traditional manufacturing, Markforged is well-positioned for market share expansion.

Materialise NV (NASDAQ: MTLS)

Materialise provides custom 3D printing solutions primarily in the medical and automotive sectors. Their strategic collaborations with industry leaders strengthen their market position, making them an attractive investment opportunity.

Evaluating Potential 3D Printing Stocks on 5starsstocks.com

For investors seeking detailed analysis of 3D printing stocks, 5starsstocks.com offers comprehensive research and expert ratings. Key features include:

Expert Analysis: The platform provides valuable insights into current market trends and advancements within the 3D printing industry.

Stock Ratings: Investors can access performance reviews, ratings, and forecasts to help guide their decision-making process.

Investment Tips: 5starsstocks.com offers strategic advice on when to buy or sell stocks based on shifting market dynamics.

Risks of Investing in 3D Printing Stocks

While investing in 3D printing stocks can offer high returns, it’s essential to consider the associated risks:

Market Volatility: Like any emerging sector, 3D printing stocks can experience significant price fluctuations driven by market sentiment.

Technology Advancements: The rapid pace of technological innovation means companies must continuously adapt to stay competitive, or they risk becoming obsolete.

Competition: With increasing market entrants, competition in the 3D printing space is rising, which can impact profitability.

The Future of 3D Printing

The future of 3D printing holds immense promise as industries continue to explore its potential. Innovations such as bioprinting (printing organic tissues), advancements in printing materials, and the growing integration of AI into 3D printing processes are set to drive the industry’s evolution. These advancements will not only expand the scope of 3D printing applications but also transform various sectors, including healthcare, aerospace, and manufacturing.

Making Informed Investment Decisions

The 3D printing sector presents lucrative opportunities for investors who are prepared to navigate this rapidly evolving field. Leveraging resources like 5starsstocks.com allows investors to make well-informed decisions based on in-depth analyses and expert insights. As 3D printing continues to revolutionize industries, adopting a strategic approach to investments is key to maximizing returns. Conducting thorough research and aligning investments with financial goals and risk tolerance will help ensure success.

Investing in 3D printing stocks goes beyond riding a trend; it’s about participating in a technological revolution poised to reshape the future of production and manufacturing.

Frequently Asked Questions

What is 3D printing and why is it important for investors?

3D printing, or additive manufacturing, creates three-dimensional objects from a digital file by layering materials. It’s transforming industries like healthcare, aerospace, and automotive. For investors, 3D printing offers the potential for significant growth due to its innovation and widespread applications across various sectors.

How do 3D printing stocks perform in the market?

3D printing stocks have shown significant growth in recent years as the technology has advanced and its applications expanded. While there are high growth opportunities, these stocks can be volatile due to factors like market sentiment, technological innovation, and competition in the space.

How can 5starsstocks.com help in evaluating 3D printing stocks?

5starsstocks.com offers expert analysis, stock ratings, and investment tips, providing investors with detailed insights into the 3D printing market. This resource helps identify high-potential companies and assists in making informed investment decisions.

What are the risks of investing in 3D printing stocks?

Investing in 3D printing stocks carries risks such as market volatility, rapid technological changes, and increased competition. Companies in the sector must continually innovate to stay relevant, and price fluctuations can occur based on broader market dynamics.

Which companies are considered top players in the 3D printing market?

Leading companies in the 3D printing space include Stratasys Ltd. (SSYS), 3D Systems Corporation (DDD), Desktop Metal (DM), Markforged (MKFG), and Materialise NV (MTLS). These companies are pioneering advancements in the industry and represent promising investment opportunities.

What is the future outlook for the 3D printing market?

The 3D printing market is expected to continue its growth trajectory, with projections estimating it will exceed $41 billion by 2026. Innovations like bioprinting, AI integration, and advancements in materials are expected to drive further market expansion, presenting long-term growth potential for investors.

How can I make informed investment decisions in the 3D printing sector?

To make informed decisions, investors should use resources like 5starsstocks.com, conduct thorough research on emerging technologies and market trends, and align their investment choices with their financial goals and risk tolerance. Staying updated on industry advancements and company performance is essential.

Conclusion

The 3D printing market is an exciting and rapidly evolving sector, offering tremendous growth potential for investors. As the technology continues to revolutionize industries from healthcare to manufacturing, it opens new avenues for innovation and market expansion. While the opportunities are vast, it’s important for investors to be aware of the associated risks, including market volatility, technological advancements, and competition.

By utilizing resources like 5starsstocks.com, investors can gain valuable insights and make informed decisions about which companies are leading the way in this transformative field. As the industry matures, staying informed and strategically aligning investments with long-term goals will be key to navigating this promising market successfully. Investing in 3D printing stocks isn’t just about capitalizing on a trend—it’s about being part of a technological revolution that is set to reshape the future of production.