Introduction: Navigating Emergency Funds in a Dynamic World

Life is unpredictable. Sudden hospital bills, unexpected family events, or temporary business cash flow shortages can all trigger an urgent need for liquid funds. In such emergencies, many individuals consider 신용카드 현금화 credit card cashing as a potential solution.

However, the online landscape is often riddled with uncertain information and potential risks surrounding this option, making it a difficult decision to navigate alone. This comprehensive guide, authored by the financial experts at Star Gift Certificate, a leading company in Korea’s financial services sector known for its commitment to transparent and safe practices, aims to cut through the ambiguity. We provide a one-stop solution offering deep insights for responsible choices, safe usage methods, and realistic alternatives. Our goal is to equip you with a clear understanding of everything related to 신용카드 현금화, empowering you to make wise and informed financial decisions.

What is 신용카드 현금화 Understanding the Concept and How It Works

신용카드 현금화 credit card cashing refers to the process of obtaining immediate cash using your credit card, diverging from its primary function of purchasing goods or services. The core principle is simple: it converts a portion of your credit card’s available payment limit credit line into liquid cash.

The Definition and Legal Structure of 신용카드 현금화

It is crucial to distinguish 신용카드 현금화 from the often-confused slang term 카드깡 card kkang.

Illegal 카드깡: This practice is strictly prohibited by the Specialized Credit Finance Business Act. It involves creating fabricated sales slips without any actual product or service transaction to generate funds. Both the merchant and the cardholder participating in illegal 카드깡 can face severe legal penalties.

Legal 신용카드 현금화: In contrast, legal credit card cashing operates as a normal commercial activity. It involves genuinely purchasing a product with real value, typically a digital gift certificate, using your credit card. This product is then officially sold to a specialized, legitimate company to secure cash.

Cash advance short-term card loan is a short-term loan product provided directly by your credit card company.

카드론 card loan long-term card loan is a longer-term loan product also offered directly by card companies.

Both 현금 서비스 and 카드론 are fundamentally loan products. They directly impact your credit score and typically incur high interest from the moment of transaction. This makes them structurally different from legal 신용카드 현금화, which is based on a legitimate product transaction, not a direct loan.

Reasons for Needing 신용카드 현금화: The Reality of Securing Emergency Funds

So, why do people consider 신용카드 현금화. While situations vary, the main reasons are as follows:

Reasons for cashing out cards:

Unexpected medical expenses: When urgent surgery or treatment costs are needed due to a sudden accident or illness.

Family event costs: When a lump sum is needed for events like weddings or funerals.

Shortage of living expenses: When short-term living funds are lacking due to job loss or a decrease in income.

Urgent business funds: For self-employed individuals who need to make sudden payments or secure operating capital.

Difficulty obtaining bank loans: When immediate bank loans are difficult to get due to a low credit score or complex procedures.

Thus, 신용카드 현금화 is considered an alternative for quickly securing cash liquidity in situations where it is hard to access traditional institutional finance.

신용카드 현금화: When and How Should You Use It

If you are considering 신용카드 현금화, you must clearly understand its principles and methods and approach it with caution.

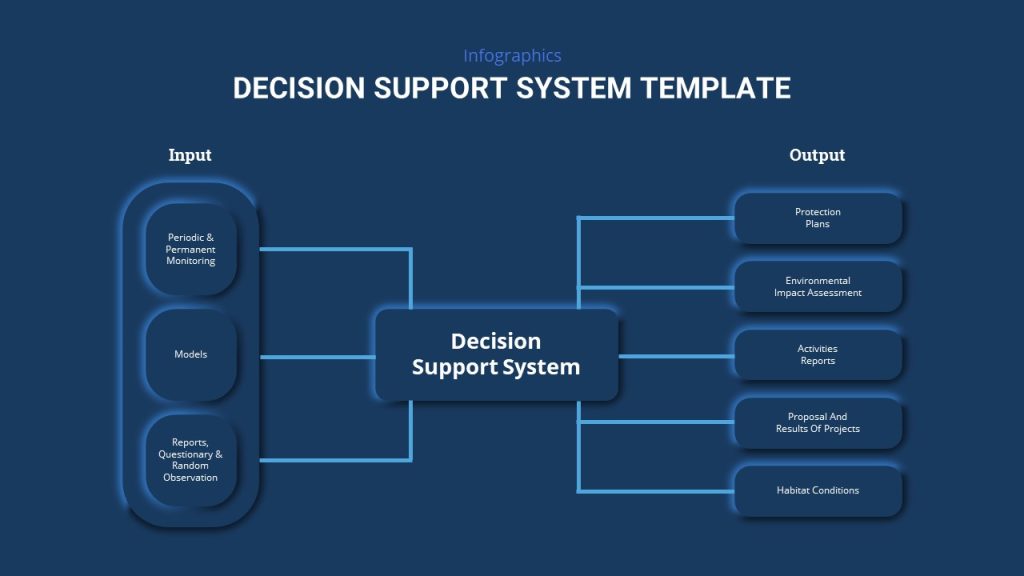

Credit card cashing principles

In-depth Analysis of the Advantages and Potential Risks of 신용카드 현금화

Advantages:

Speed: You can secure cash within minutes, without the complex document screening required for bank loans.

Convenience: It is often possible to apply and use the service online, 24/7.

Accessibility: As long as you have a remaining credit card limit, you can use it without a separate credit check.

Potential Risks Disadvantages:

High Fees: Fees are incurred in the cashing process, such as gift certificate purchase fees, which can be a burden similar to a high interest rate.

Potential Impact on Credit Score: Excessive use in a short period or delinquency on installment payments could be classified as excessive use for cash financing by the card company’s risk management system, negatively affecting your credit score.

Risk of Overspending and Debt Accumulation: Using it indiscriminately with the thought of having immediate cash can lead to a snowballing credit card bill, trapping you in a cycle of debt.

Legal 신용카드 현금화 vs. The Dangers of Illegal Channels

To make a safe choice, you must clearly recognize the boundary between legal and illegal methods.

Legal Channels: These are conducted through officially registered businesses such as gift certificate purchasing companies. They have transparent fee policies and guarantee a secure transaction system.

Illegal Channels: Transactions through unregistered companies or individuals are extremely dangerous. They may steal your card information for voice phishing or card cloning, or they might disappear after receiving the card details without paying you. Both the Financial Supervisory Service and the Korea Consumer Agency continuously issue warnings about such illegal financial fraud.

Alternatives to 신용카드 현금화: Smart Financial Management Strategies

신용카드 현금화 should be considered a last resort. There are several smarter alternatives you can try first.

Small Loan Products and Emergency Fund Strategies

Government-Supported Financial Products: It is wise to first look into government-supported loan products for low-credit individuals, such as Sunshine Loan 햇살론 or Saehimang Holssi 새희망홀씨.

Bank Small-Scale Credit Loans Overdraft Accounts: Emergency loans or overdraft accounts from your primary bank can often be used at relatively low interest rates.

Long-term Emergency Fund Building: The most fundamental solution is to consistently save a portion of your income to build an emergency fund equivalent to three to six months of living expenses.

Other Support Systems for Overcoming Financial Difficulties

If financial difficulties persist, it is important to seek help from professional institutions rather than struggling alone. The Credit Counseling and Recovery Service and local financial welfare counseling centers offer various support programs, including debt adjustment and financial counseling.

In moments of desperation, individuals might be tempted to explore risky shortcuts such as 휴대폰 소액결제 한도 조회 or 휴대폰 소액결제 미납 정책 뚫는법. However, these are not fundamental solutions and can quickly escalate into even larger financial problems. It is always wiser to seek sustainable solutions through official financial counseling.

Practical How-to Guides for Financial Emergencies

How to Safely Use a 신용카드 현금화 Service

Step 1 Research Reputable Companies: Confirm that the company is a legally registered business check for a business registration number.

Step 2 Compare Fees Transparently: Ensure the company clearly states all fees upfront during the consultation, with no hidden costs.

Step 3 Understand the Process: Know exactly how the transaction works, such as purchasing and then selling a digital gift certificate.

Step 4 Protect Your Information: Never share highly sensitive information like your card PIN or the full CVC number.

Step 5 Confirm the Transfer: After the transaction, immediately check your bank account to confirm that the funds have been transferred correctly.

Step 6 Plan for Repayment: As soon as you receive the cash, create a clear plan to pay off the credit card bill on time.

How to Build an Emergency Fund

Step 1 Set a Goal: Calculate your essential monthly living expenses and aim to save three to six times that amount.

Step 2 Open a Separate Account: Keep your emergency fund in a separate, high-yield savings account to avoid accidentally spending it.

Step 3 Automate Your Savings: Set up an automatic transfer from your checking account to your emergency fund account each payday.

Step 4 Start Small: Even small amounts add up. Cut minor expenses like daily coffee and redirect that money to your fund.

Step 5 Save Windfalls: If you receive any unexpected money such as a bonus or tax refund, put a significant portion of it directly into your emergency fund.

Frequently Asked Questions FAQ about 신용카드 현금화

Q1 Is 신용카드 현금화 legal

A: It depends on the method. The legal method involves a real transaction, like buying a gift certificate and selling it. The illegal method known as 카드깡, involves creating fake transactions purely to generate cash and is against the law. Always use a legitimate service.

Q2 What is the typical fee for 신용카드 현금화

A: Fees vary between providers but are typically a percentage of the transaction amount. It is crucial to get a clear quote before proceeding. Reputable companies will be transparent about their fee structure.

Q3 Will using 신용카드 현금화 affect my credit score

A: It can. While it is not a direct loan, credit card companies monitor usage patterns. Frequent or large-volume cashing transactions might be flagged as a risk, and failing to pay the resulting card bill on time will certainly lower your credit score.

Q4 What is the difference between 신용카드 현금화 and a cash advance 현금 서비스

A: 신용카드 현금화 is a process of converting your credit limit into cash through a product transaction. A cash advance 현금 서비스 is a direct loan from your credit card issuer, which starts accruing high interest from the moment you withdraw the cash and is clearly recorded as a loan on your credit report.

Final Guide for Making a Smart and Safe 신용카드 현금화 Choice

If, after reviewing all alternatives, 신용카드 현금화 is unavoidable, you must follow this checklist to ensure a 안전한 신용카드 현금화 safe credit card cashing process.

Check for Official Business Registration: Always verify that the company is legally registered.

Demand Transparent Fee Information: Ensure fees are clearly explained with no requests for additional costs.

Beware of Excessive Personal Information Requests: A company asking for your card password or full CVC number is a scam.

Verify Operational Status: Check if the official website and customer service are active and look for genuine user reviews.

Conclusion and Key Takeaways: A Proposal for a Responsible Financial Life

신용카드 현금화 can be a useful tool to put out an urgent fire, but it is a double-edged sword.

Accurate Understanding: Understand that it is a means of securing cash using your credit limit, not a loan.

Risk Awareness: Be clearly aware of the potential risks, including high fees and the possibility of a lower credit score.

Safe Choices: When using the service, you must go through a legal and trustworthy company.

Consider Alternatives First: Always consider other options like small loans or government support first.

Ultimately, 신용카드 현금화 is a last resort to be considered carefully in an emergency. Do not forget that the most important thing is to build a solid financial foundation through consistent savings and planned consumption.

References and Further Reading

Financial Supervisory Service Republic of Korea: https://english.fss.or.kr

Korea Consumer Agency: https://www.kca.go.kr/eng/main.do